❄️COLD🔥HOT- Do Market Conditions Change How VCs Think? The Surprising Answer

- Hurratul Maleka Taj

- Aug 10, 2025

- 6 min read

Updated: Aug 16, 2025

When markets are booming, investors chase growth. When markets are tight, they scrutinize profits. That’s not just folklore - it’s now experimentally proven in a landmark Q1 study by Simon Kleinert (University of Cologne) & Marie Hildebrand (Maastricht University), "Venture Capitalists’ Decision-Making in Hot and Cold Markets: The Effect of Signals and Cheap Talk" (Entrepreneurship Theory and Practice, 2024).

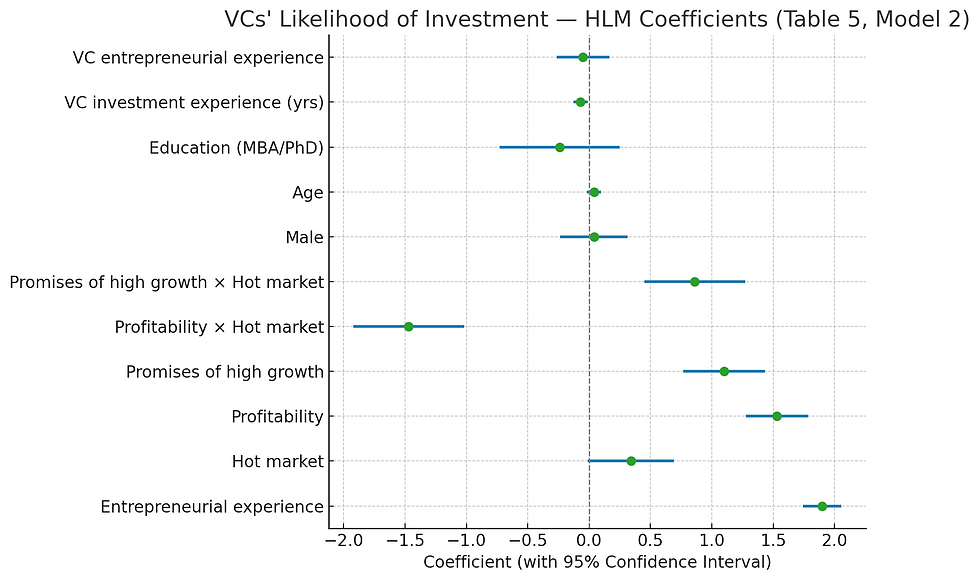

This coefficient plot comes directly from Table 5: HLM Results in Kleinert & Hildebrand’s 2024 paper.

I’ve used the Model 2 column because it includes both the main effects (e.g., profitability, growth promises, hot market) and the interaction terms (e.g., profitability × hot market, growth promises × hot market).

The numbers plotted are the hierarchical linear model (HLM) coefficients with their 95% confidence intervals (computed from the reported standard errors).

How to read it: Interaction Line Plot Interaction Line Plot

Each dot represents the estimated effect of that variable on VCs’ likelihood of investment (scale 1–7), holding all other factors constant.

Horizontal bars show the 95% CI - if a bar crosses zero, the effect isn’t statistically significant at p<.05.

Positive coefficients mean the attribute increases investment likelihood; negative ones mean it decreases it.

What it shows:

Entrepreneurial experience is the single strongest positive driver (+1.90).

Profitability is strongly positive (+1.53) on average, but the large negative interaction with “Hot market” (−1.47) shows its effect vanishes when markets heat up.

Promises of high growth are positive (+1.10) and become even more influential in hot markets (+0.86 interaction).

Controls like gender, age, and education have negligible effects here.

How I plotted it:

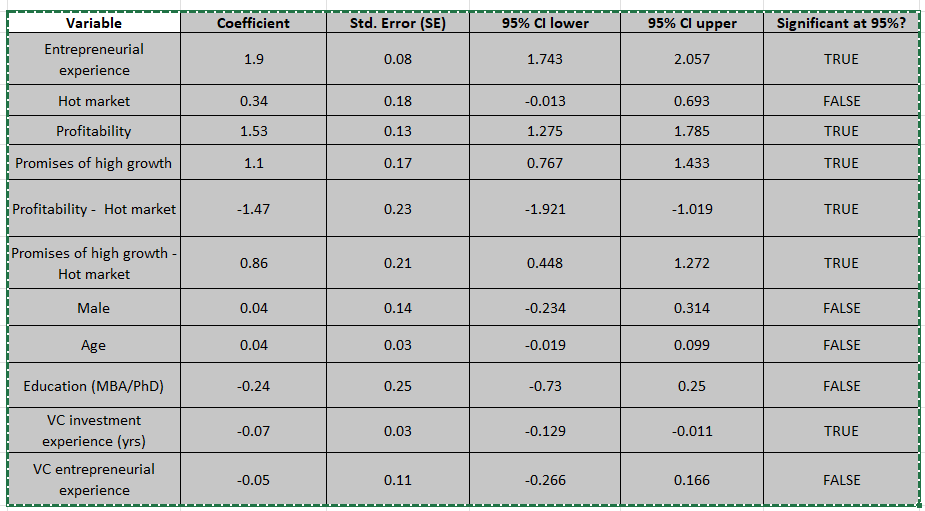

Data: Coefficients and standard errors taken verbatim from Table 5, Model 2.

Method: Calculated lower and upper CI bounds = coefficient ± (1.96 × SE).

Tool: Matplotlib in Python

X-axis: Coefficient values; Y-axis: Variables from the model. Reference line at 0 for easy visual comparison.

This visual makes the study’s core message tangible:

📉 In hot markets, VCs’ attention to profitability nearly disappears.

📈 In the same conditions, growth narratives dominate decision-making.

Note: In the model, cold markets are the baseline for comparison - they’re not shown as a separate line in Table 5 because all coefficients are measured relative to them. A “Hot market” coefficient shows how much the effect changes when moving from cold to hot conditions.

1. The Core Question

Do market conditions (hot vs. cold) change how much weight VCs give to:

Costly signals (verifiable: e.g., profitability) vs.

Cheap talk (unverifiable: e.g., “We’ll grow 200% next year”)?

Hot market = high funding availability, frothy valuations.

Cold market = capital scarcity, risk aversion.

2. The Experiment

Sample: 76 institutional early-stage VCs in DACHNL countries

Design: Metric conjoint experiment

Stimuli: 8 startup profiles (tech, early growth, paying customers), varying by:

Profitability (yes/no)

Growth promise (high/moderate)

Founder track record (serial/first-time)

Assignment: Hot vs. cold market scenario (validated via interviews)

Analysis: Hierarchical Linear Modeling with clustered robust SEs

3. The Breakthrough Findings

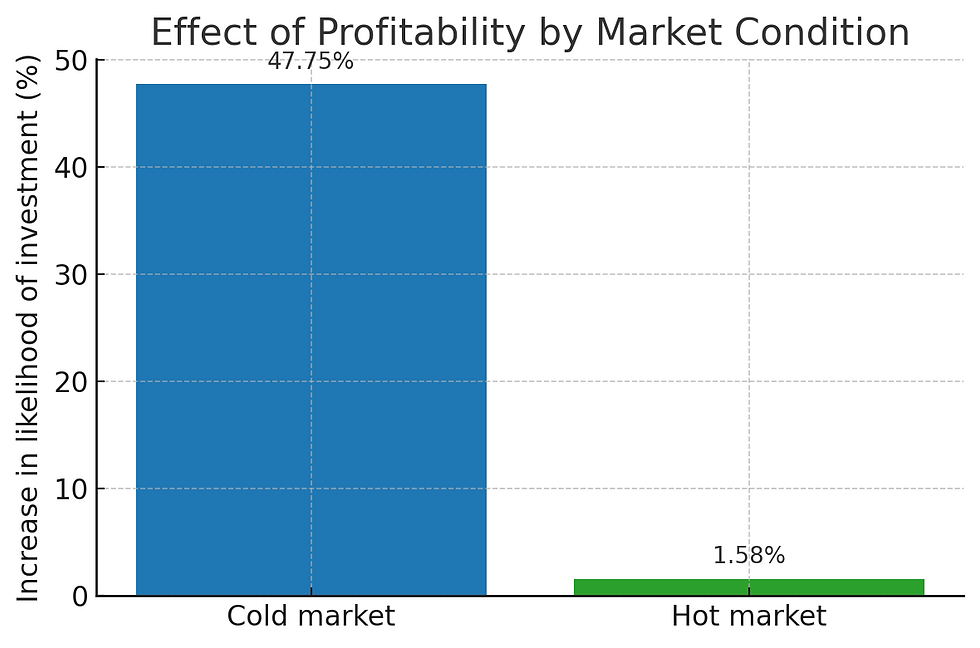

-> Profitability (Signal)

In cold markets, profitability ↑ investment likelihood by +47.75%

In hot markets, effect drops to +1.58% (statistically negligible)

Plot 2: Profitability’s Effect by Market Condition

Where the data comes from

Source: Figure 3a and the Results section right after Table 5 in Kleinert & Hildebrand (2024).

The authors report average marginal effects from Model 2 for profitability in each market condition:

Cold market (baseline): +47.75%

Hot market: +1.58%

These percentages were calculated from the regression coefficients in Table 5, applying them separately for cold vs. hot market scenarios.

What the data means

In cold markets, profitability functions as a strong costly signal, assuring investors of stability and reducing perceived risk.

In hot markets, attention shifts away from operational track records — profitability barely moves the needle on investment decisions.

How the plot was made

Data taken verbatim from Figure 3a / marginal effect estimates in the results.

Plotted in Python (Matplotlib) as a simple bar chart for visual clarity.

Blue = Cold market, Green = Hot market.

Y-axis shows % change in likelihood of investment relative to a non-profitable startup.

Interpretation This stark contrast illustrates a moderation effect:

Cold markets -> Analytical, risk-averse, signal-driven decisions.

Hot markets -> Heuristic, growth-chasing, signal-neglecting decisions. It’s experimental proof that the same metric (profitability) can be decisive in one context and irrelevant in another.

Data source: Marginal effects reported in the Results section immediately after Table 5, showing that profitability raises investment likelihood by +47.75% in cold markets but only +1.58% in hot markets.

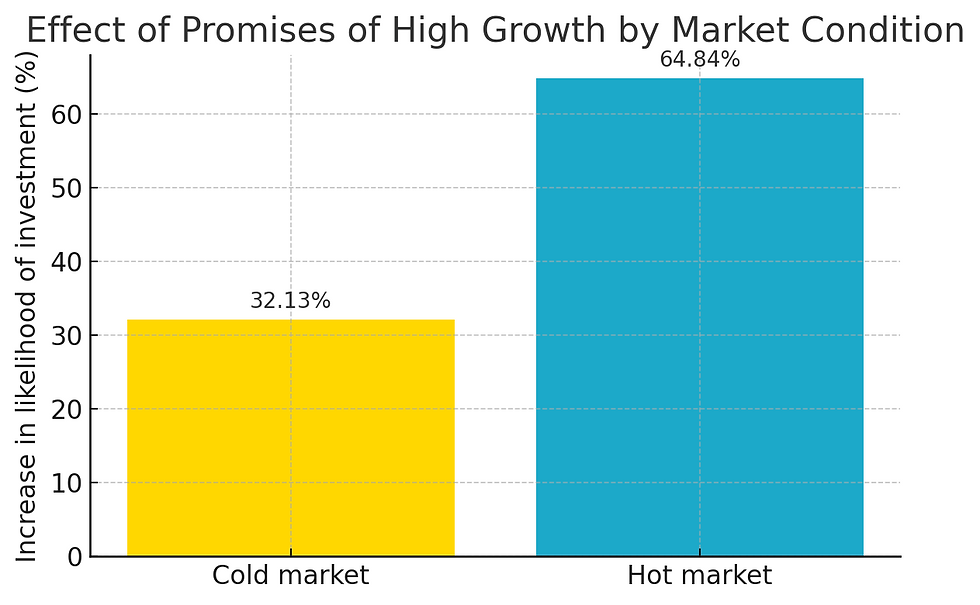

-> Growth Promises (Cheap Talk)

In hot markets, growth promises ↑ investment likelihood by +64.84%

In cold markets, only +32.13%

Plot 3: Effect of Promises of High Growth by Market Condition.

Data source: Marginal effects from Model 2, reported in the Results section immediately after Table 5, and visualized in Figure 3b.

Hot market: +64.84%

Cold market: +32.13%

What it means:

High-growth projections - a form of cheap talk - are persuasive in both market types, but their power almost doubles in hot markets.

This contrasts with profitability’s pattern in Plot 2, where the effect collapsed in hot conditions.

The finding supports the authors’ claim that in boom periods, VCs shift from signal-driven to salience-driven decision-making, heavily rewarding compelling growth stories.

How it was plotted:

Data taken directly from the reported marginal effects (percent change in likelihood of investment) for cold and hot market groups.

Shown as a simple two-bar chart for side-by-side comparison.

Colors: blue for cold market, purple for hot market.

Data source:

Marginal effect results from Model 2 in Table 5, as reported in the Results section and illustrated in Figure 3a (profitability) and Figure 3b (growth promises) of Kleinert & Hildebrand (2024).

Reported values:

Profitability: Cold = +47.75%, Hot = +1.58%

Promises of high growth: Cold = +32.13%, Hot = +64.84%

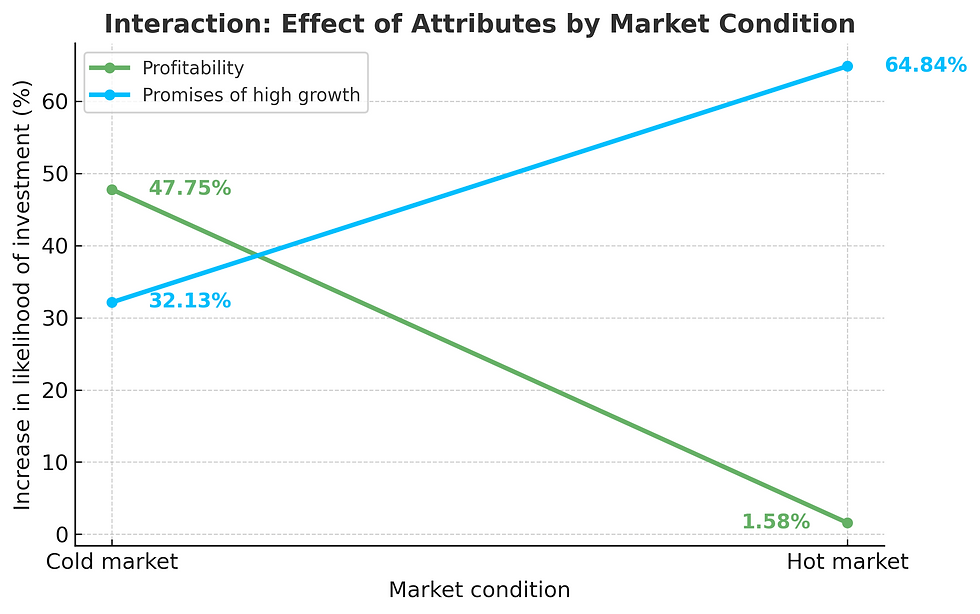

What it shows:

The green profitability line plunges from nearly +48% in cold markets to just +1.6% in hot markets - confirming the study’s first hypothesis (H1) that profitability as a costly signal loses power when the market heats up.

The blue growth promise line rises from +32% in cold markets to almost +65% in hot markets - supporting the second hypothesis (H2) that cheap talk becomes far more persuasive when capital is abundant and competition is fierce.

Why it matters:

This plot visually captures the cognitive shift VCs undergo across market cycles:

Cold markets: Analytical, risk-averse, focused on hard signals (System 2 thinking).

Hot markets: Heuristic, optimism-driven, swayed by compelling growth narratives (System 1 thinking).

Even sophisticated investors reweight their decision criteria when market sentiment changes.

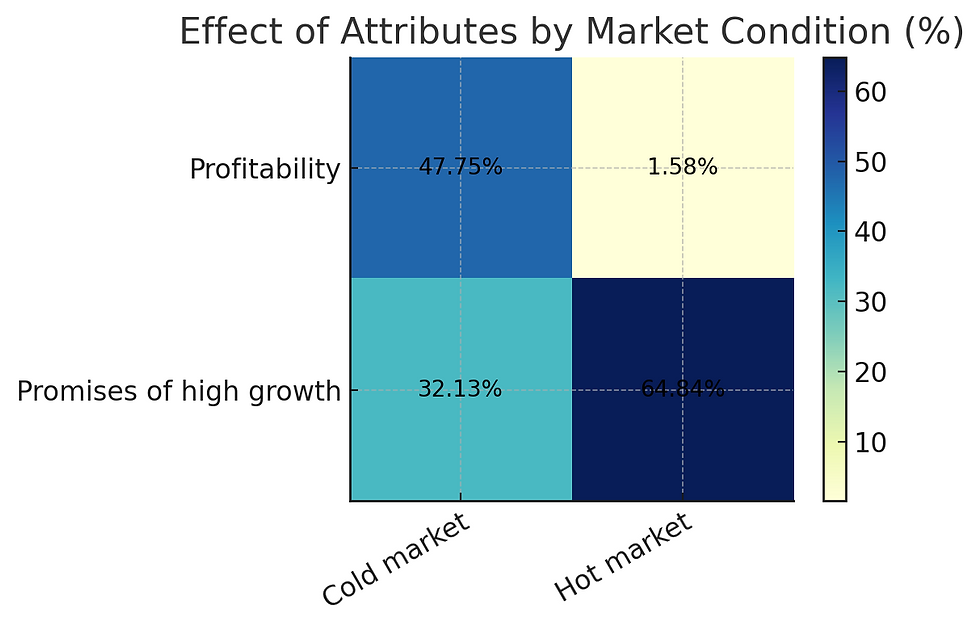

Plot 5 : Heat Map

Data source:

Marginal effects from Model 2 in Table 5, reported in the Results section and visualized in Figure 3a (profitability) & Figure 3b (growth promises).

Values:

Profitability: Cold = +47.75%, Hot = +1.58%

Promises of high growth: Cold = +32.13%, Hot = +64.84%

What it shows:

The heat map condenses the patterns from Plots 2, 3, and 4 into a single visual.

Profitability shines bright in cold markets (47.75%) but fades almost entirely in hot markets (1.58%).

Growth promises flip the script — modest impact in cold markets (32.13%) but dominant influence in hot markets (64.84%).

Why it matters:

This visual underscores how market sentiment flips the weighting of signals vs cheap talk.

The change isn’t subtle - it’s a wholesale re-prioritization of what drives VC decisions, confirming the paper’s hypotheses (H1 & H2) and aligning with dual-process theory:

Cold markets = signal-driven (System 2)

Hot markets = salience-driven (System 1)

-> Overall

Across all conditions, cheap talk had a larger average effect (+48.29%) than profitability (+21.11%)

Founder track record had the single strongest main effect (b = 1.90, p < .01)

4. Why It Matters

This study shows context-adaptive heuristics in venture capital:

Cold markets -> analytical, signal-driven (System 2)

Hot markets -> heuristic, salience-driven (System 1)

Even sophisticated VCs - with years of experience - shift from spreadsheets to storyboards when the market heats up.

5. My Research Review Reflections

From a decision-science perspective, this aligns with dual-process theory and bounded rationality:

Market temperature acts as a cognitive frame that changes information weighting.

This may help explain funding bubbles and over-investment in narrative-driven startups during booms.

From a portfolio-theory lens:

Hot markets may produce risk clustering in overhyped sectors because due diligence weight tilts toward narratives.

Cold markets may produce conservative overfitting toward current profitability, potentially missing transformative but pre-revenue plays.

6. Implications for Stakeholders

Founders

In hot markets, craft compelling, high-growth narratives - data may play second fiddle.

In cold markets, unit economics and profitability take center stage.

VCs

Be aware of your own cognitive shift - market sentiment may unconsciously reweight your criteria.

LPs

Ask GPs about how market cycles affect screening criteria - avoid herd behavior risk.

7. Open Questions for Future Research

Do gender or minority founders experience different signal vs. cheap talk weighting?

Does fund size or LP pressure amplify hot-market narrative bias?

Can AI-driven screening dynamically reweight attributes based on market sentiment without losing objectivity?

💬 Your Turn Have you noticed this in your own investing or fundraising journey? Drop your thoughts — I’m especially curious to hear from VCs who’ve operated across both boom and bust cycles.

#venturecapital #startups #VC #entrepreneurship #caltech #harvard #mitsloan #TheUnstoppableLab #a16z #sequoia #Antler #lightspeed #ycombinator #PrivateEquity #GlobalInvesting #CapitalMarkets #InvestmentStrategy #StartupEcosystem #InnovationLeadership #Entrepreneurship #BusinessStrategy #LeadershipInsights #EconomicDevelopment #WomenInLeadership #ImpactInvesting #GenderLensInvesting #InclusiveCapital #WomenFounders #EquitableFunding

Comments